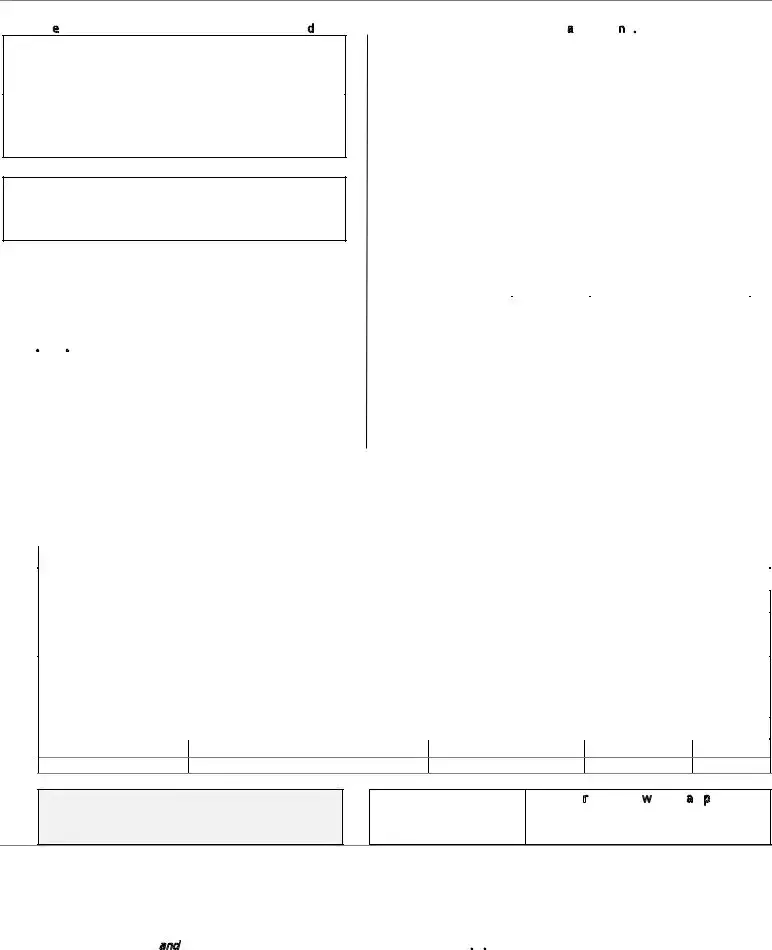

Blank Alaska Quarterly Contribution Report PDF Template

Navigating the complexities of employment contributions is a critical task for businesses operating in Alaska, and the Alaska Quarterly Contribution Report form plays a pivotal role in this process. With a taxable wage base of $36,900 per employee for the year 2013, this form meticulously details the contributions due each quarter, encompassing both employer and employee portions. Employers are required to file this report even in the absence of wage payments for a given quarter, underscoring the form's significance in maintaining compliance with state labor laws. The convenience of online filing is mentioned, alongside the availability of a dedicated website and contact number for assistance, delineating a modern approach to fulfilling this obligation. Further emphasizing its importance, the document elaborates on the necessity to report the number of workers, total reportable wages, and contributions due. Additionally, it touches upon the potential for this information to be utilized in verifying eligibility for other government programs, indicating a broader governmental use of the data collected. The form also guides on amending previously filed reports, ensuring accuracy and compliance in reporting. Complete with instructions for remitting payments and the process for reporting wages to other states, the Alaska Quarterly Contribution Report form is a comprehensive tool designed to streamline the reporting of employment contributions, thereby facilitating a smoother operational flow for businesses within the state.

Document Example

Alaska Quarterly Contribution Report

THE 2013 TAXABLE WAGE BASE FOR EACH EMPLOYEE IS $36,900.

Quarter Hnding: |

Due Gate: |

Employer DccountQo: |

FEIN:

AGENCY USE ONLY

A report must be filed even if no wages are paid for the quarter.

You may now file your quarterly contribution report online. Please visit our web site located at www.labor.state.ak.us/estax or call

8884483527. To amend your quarterly report, please submit a “Correction of Wage Item,” Form TADJ also available online.

Notice to employers: Wage information and other confidential UC information may be requested and utilized for other authorized governmental purposes, including, but not limited to, verification of an individual’s eligibility for other government programs.

1. For each month, report the number |

|

|

If none enter "0" |

||||||

|

|

|

|

|

|

||||

|

1st |

|

2nd |

3rd |

|||||

of workers who worked during or |

|

|

|

||||||

|

Month |

|

Month |

Month |

|||||

received pay for the payroll period, |

|

||||||||

|

|

|

|

|

|

||||

which includes the 12th of the month. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2. |

Total reportable wages paid this |

|

|

|

|

|

|

|

|

|

quarter. (See Instructions, page 2) |

|

$ |

|

|

|

|

|

|

3. |

Less excess wages over the taxable |

($ |

|

|

|

) |

|||

|

wage base. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

4. |

Taxable wages paid this quarter. |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer's rate |

|

|

|

|

|

|

|

5. |

Employer's contribution |

|

% |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's |

|

|

|

|

|

|

|

6. |

Employee's contribution |

Rate |

|

$ |

|

|

|

|

|

.68% |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

7. Total contributions due |

Total Rate |

|

|

|

|

|

|

||

|

% |

$ |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Amount remitted |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Wages reported to other states? See |

|

|

|

Yes |

|

|||

|

|

|

|

||||||

|

instructions explaining this on page 2. |

|

|

|

|

||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

*see area map for geographic location codes

|

10. Employee's |

11. Employee's Qame - Wype or Srint |

12. Reportable wages |

13. Full |

14. |

|||

|

|

Social Security |

(Do not list employees more than once.) |

paid this quarter. |

Occupational |

Geographic |

||

|

|

Number |

Last |

First |

MI |

(No negative wages) |

WLtle or Fode |

FRde * |

S |

|

|

|

|

|

|

|

|

T N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

A O |

|

|

|

|

|

|

||

P |

|

|

|

|

|

|

|

|

L |

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

E |

T |

|

|

|

|

|

|

|

|

U |

|

|

|

|

|

|

|

C B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

H S |

|

|

|

|

|

|

||

E |

|

|

|

|

|

|

|

|

C P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

K L |

|

|

|

|

|

|

|

|

S |

E |

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

HS E E

R |

Make checks payable to the |

15. Total Qumber of Sages 16. Total Ueportable Zages - Dll Sages |

E |

||

|

Alaska Department of Labor and Workforce Development |

(Same Wotal as in Block 2 above.) |

|

If you have any questions, |

|

|

call toll free 8884483527 |

|

I hereby certify that the information on this report is true and correct.

Signed: ________________________________________________ Title: ________________________________ Date: ________________

Printed Name: |

Contact telephone number: ( |

) |

Alaska Department of Labor DQG Workforce Development, Employment Security Tax, PO Box 115506, Juneau, AK

TQ01C (11/1)

Document Specifics

| Fact | Detail |

|---|---|

| Taxable Wage Base for 2013 | $36,900 per employee |

| Filing Requirement | A report must be filed each quarter even if no wages are paid. |

| Online Submission | Reports can be filed online at the Alaska Department of Labor and Workforce Development website. |

| Use of Information | Wage information may be used for verifying eligibility for other government programs. |

Instructions on How to Fill Out Alaska Quarterly Contribution Report

Filling out the Alaska Quarterly Contribution Report is a requirement for employers in Alaska to remain compliant with state labor laws. This report allows the state to track wages paid and contributions due, ensuring that the unemployment insurance system is funded and functioning properly. For those who prefer the ease of electronic filing, the option to submit this report online is available. Understanding the steps to complete this form correctly is crucial for businesses to avoid penalties and maintain good standing. Here's a straightforward guide on how to fill out the form.

- Start by visiting the official website provided (www.labor.state.ak.us/estax) to access the form or call the toll-free number (888-448-3527) if you have questions or need guidance on how to file online.

- Enter the quarter ending date in the space provided for "Quarter Ending".

- Fill in the "Due Date" as specified by the agency.

- Provide your "Employer Account No." and "FEIN" (Federal Employer Identification Number) in the designated fields.

- For each month in the quarter, report the number of workers who worked during or received pay for the payroll period that includes the 12th of the month. If no employees were present, enter "0".

- Input the total reportable wages paid in the quarter into the space labeled "Total reportable wages paid this quarter." Refer to the instructions on page 2 for clarity on what constitutes reportable wages.

- Deduct any excess wages over the taxable wage base ($36,900 for 2013) and enter this amount.

- Calculate the taxable wages paid this quarter after subtracting excess wages and enter this amount.

- Input the employer's contribution rate, which is a percentage.

- Enter the employee's contribution amount using the rate of .68% to derive the total contributions due.

- State the amount remitted by entering the total contributions paid.

- Indicate whether wages were reported to other states by marking "Yes" or "No". If "Yes", see instructions on page 2 for further details.

- List each employee's name, reportable wages paid this quarter, social security number, and occupational and geographic codes according to the provided area map.

- Verify the total number of pages and the total reportable wages, ensuring they match the total from block 2 above.

- Make your check payable to the Alaska Department of Labor and Workforce Development and attach it to your report if you're not filing online.

- Sign, date, and print your name along with your title and contact telephone number to certify that the information provided is true and correct.

Submitting this form correctly and on time is vital to comply with Alaska's employment regulations. It ensures that your business contributes appropriately to the state's unemployment insurance program, which is a safety net for people who have lost their jobs. By following these steps, you can accurately report your contributions each quarter, helping to keep Alaska's workforce strong and supported.

What You Should Know About This Form

What is the due date for the Alaska Quarterly Contribution Report?

The Alaska Quarterly Contribution Report is due following the end of each quarter. To find the specific due date for the current quarter, please refer to the "Due Date" section at the top of the form. Timely submission is crucial to avoid penalties and interest charges for late reporting.

Can I file the Alaska Quarterly Contribution Report online?

Yes, you can file your quarterly contribution report online. This streamlined process is encouraged for its efficiency and convenience. For online filing, please visit the employment security tax section at www.labor.state.ak.us/estax or call 888-448-3527 for assistance. Online services are designed to simplify your reporting process.

What should I do if I need to amend a previously submitted Alaska Quarterly Contribution Report?

If you find that you need to amend a previously submitted report, you must submit a “Correction of Wage Item,” using Form TADJ. This form is also available online. Amendments are necessary to correct any inaccuracies in wage data or contributions reported and ensure compliance with state regulations.

Are there any conditions under which I do not need to file a report for a quarter?

A report must be filed for every quarter, even if no wages were paid during the period. Filing a report with zero wages ensures your account remains in good standing and accurately reflects your payroll records for the respective quarter.

How do I report wages and calculate contributions due for the Alaska Quarterly Contribution Report?

When completing the Alaska Quarterly Contribution Report, first list the number of workers who worked or were paid during each month of the quarter. Then, report the total reportable wages paid during the quarter. From this total, subtract any excess over the taxable wage base of $36,900 for each employee to determine taxable wages. Apply the employer's contribution rate to the taxable wages to calculate the employer's contribution. Include the employee's contribution by applying the rate of .68% to taxable wages. The total contributions due are then calculated, including both employer's and employee's contributions. Ensure accurate calculation to comply with state requirements and avoid underpayment or overpayment of contributions.

Common mistakes

Not reporting the number of workers for each month correctly: It's important to report the exact number of employees who worked or were paid during each month's payroll period that includes the 12th. If no employees were paid, entering "0" is necessary. Neglecting to provide accurate figures can lead to discrepancies and potential audits.

Failing to calculate the total reportable wages accurately: Total reportable wages for the quarter must be calculated carefully, taking into account all payments to employees. Oversight or miscalculation of this sum can affect the accuracy of contributions due.

Incorrectly deducting excess wages over the taxable wage base: The 2013 taxable wage base is $36,900 per employee. Contributions are only due on wages up to this amount. Omission or incorrect calculation of excess wages can result in either underpayment or overpayment of employer contributions.

Misunderstanding the employer and employee contribution rates: Both the employer's contribution rate and the employee's contribution rate (.68%) are crucial for determining the total contributions due. Misapplying these rates can cause errors in the amount remitted.

Omitting wages reported to other states or geographic location codes: If wages have been reported to another state, indicating this on the form is crucial, as is including correct geographic location codes. Missing or inaccurate information in this area can lead to incomplete or incorrect submissions.

To enhance the accuracy of reporting and ensure compliance, individuals are encouraged to double-check these critical elements before submitting their Alaska Quarterly Contribution Report. Additionally, utilizing the online filing system at www.labor.state.ak.us/estax can streamline the process and help avoid these common mistakes.

Documents used along the form

When businesses in Alaska prepare their Quarterly Contribution Report, several other forms and documents can be crucial for ensuring accuracy and compliance with the state's regulations. These ancillary documents play a pivotal role in providing a comprehensive overview of a business's payroll and tax obligations. Here, we detail some of these vital documents, emphasizing their purpose and importance in the broader context of employment and tax reporting in Alaska.

- Employer Registration Form: This document is essential for any new business. It registers the business with the Alaska Department of Labor and Workforce Development, allowing it to receive an employer account number necessary for filing quarterly reports.

- Employee Wage Report: Detailed records of each employee's wages are maintained in this document. It serves as a basis for calculating total reportable wages and contributions on the quarterly contribution report.

- Notice of Change: Companies use this form to report any changes in their business operations, such as changes in ownership, address, or business closure. It helps keep the state updated on the current status of the business.

- Unemployment Insurance Rate Notice: Issued by the state, this document informs businesses of their unemployment insurance tax rate for the year, which is necessary for accurately computing contributions on the quarterly report.

- Correction of Wage Item (Form TADJ): If errors are found in previously submitted wage reports, this form is used to make corrections. It ensures that contributions are based on accurate wage data.

- Payment Voucher: Accompanies the Quarterly Contribution Report for businesses that opt to mail their payment. This voucher ensures that payments are correctly credited to the business’s account.

- Power of Attorney (POA) Form: This form authorizes another individual or entity to act on behalf of the business in matters related to employment security tax. It is beneficial for businesses that outsource their payroll or tax reporting functions.

- Online Filing System Setup: Though not a physical document, setting up an account on Alaska’s online filing system is a critical step. It facilitates the electronic submission of the Quarterly Contribution Report and associated payments, streamlining the reporting process.

Understanding and utilizing these documents can significantly simplify the process of reporting and paying employment taxes in Alaska. Ensuring these forms are correctly filled out and submitted promptly can help businesses avoid penalties and maintain good standing with the Alaska Department of Labor and Workforce Development. Accurate and timely reporting benefits both the employer and the employees by contributing to the efficient administration of unemployment insurance benefits and maintaining the integrity of the employment security system in Alaska.

Similar forms

The Federal Unemployment Tax Act (FUTA) Tax Return is one document that shares similarities with the Alaska Quarterly Contribution Report. Both documents require employers to report wages paid to employees and calculate contributions or taxes owed based on those wages. The FUTA Tax Return, like the Alaska form, involves determining net taxable wages after excluding certain types of compensation and applying specific tax rates to compute the employer’s federal unemployment tax liability. These forms play crucial roles in funding unemployment benefits, albeit on federal and state levels respectively.

The Form W-3, Transmittal of Wage and Tax Statements, is another document akin to the Alaska Quarterly Contribution Report. This form summarizes the information reported on individual W-2 forms for all employees of a business, including wages paid and taxes withheld. Similarly, the Alaska report aggregates employee wages and contributions for the quarter. Both forms serve the purpose of consolidating wage and tax information for governmental review and record-keeping, thereby ensuring compliance with tax and employment laws.

State-specific Quarterly Wage Reporting forms found in other states bear resemblance to the Alaska Quarterly Contribution Report as well. These forms collect data on the wages employers pay to their employees and calculate state unemployment insurance contributions due. While each state has unique requirements and tax rates, the underlying purpose of these documents is the same: to fund state unemployment benefit programs and maintain employment records. Employers must accurately report their payroll expenses and contributions within their respective jurisdictions.

The Employer’s Quarterly Federal Tax Return, IRS Form 941, is a document similar to the Alaska Quarterly Contribution Report in several aspects. Form 941 is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of Social Security or Medicare tax. Like the Alaska report, Form 941 is filed quarterly and is critical for compliance with federal tax obligations, underscoring the parallel in their purposes of reporting and paying employment taxes.

The Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return in states like New York is a comprehensive form that closely aligns with the Alaska Quarterly Contribution Report in function. It combines the reporting of wages, the computation of withheld taxes, and unemployment insurance contributions into one unified document. This integration facilitates streamlined reporting for employers, ensuring that both income tax and unemployment insurance obligations are met concurrently.

The New Hire Reporting form, required in many states, although serving a slightly different primary purpose, shares a commonality with the Alaska Quarterly Contribution Report. This form mandates that employers report newly hired or rehired employees within a certain timeframe. The information collected helps agencies detect unemployment compensation fraud and enforce child support orders. Despite focusing on new hires specifically, it complements the broader wage reporting and contributes to a comprehensive employment data collection system, similar to the Alaska form’s role in tracking employment and wage information quarterly.

Dos and Don'ts

When completing the Alaska Quarterly Contribution Report form, there are several important practices to keep in mind to ensure accuracy and compliance. Here's a list of things you should and shouldn't do:

Do:- Report accurately: For each month of the quarter, accurately report the number of workers who worked or received pay for the payroll period including the 12th of the month. If no workers were paid, enter "0".

- File even if no wages are paid: A report must be filed for each quarter, even if no wages were paid during that period.

- Utilize online resources: Consider filing your quarterly contribution report online for convenience. The Alaska Department of Labor website offers tools and forms needed for electronic submission.

- Amend reports if necessary: If you need to make corrections to your quarterly report, submit a "Correction of Wage Item" Form TADJ as instructed online.

- Check wage base and contributions: Ensure total reportable wages, less excess wages over the taxable wage base (for 2013, it's $36,900 per employee), and corresponding employer and employee contributions are calculated correctly.

- Include all necessary details: Fill in all the required fields for employee information, including name, reportable wages, and social security numbers. Avoid listing employees more than once.

- Overlook the due date: Be aware of the deadline for submitting your quarterly report to avoid penalties. Reports are due soon after the quarter ends.

- Forget to sign and date: The form must be signed and dated by an authorized individual. Ensure the printed name and contact telephone number fields are also completed.

- Ignore payment instructions: If you owe contributions, make your checks payable to the Alaska Department of Labor and Workforce Development and follow the mailing instructions correctly.

- Misreport wages: Do not inaccurately report wages or fail to report wages paid to employees. This includes correctly distinguishing between reportable wages and excess wages over the taxable wage base.

- Disregard geographic codes: When noting employee information, make sure to use the correct geographic location codes as specified in the instructions.

- Miss the opportunity for electronic filing: Avoid skipping the option to file electronically, as it can simplify the submission process and help ensure the accuracy of your report.

Misconceptions

Despite its straightforward nature, the Alaska Quarterly Contribution Report form is often misunderstood in several key aspects. These misconceptions can lead to errors in filing, potentially causing complications for employers.

- Myth 1: If an employer hasn’t paid wages in a quarter, they don’t need to file a report.

Contrary to what many believe, an Alaska Quarterly Contribution Report must be filed for every quarter, regardless of whether wages were paid. This stipulation ensures that the Alaska Department of Labor maintains accurate records of all operating employers within the state. - Myth 2: The report can only be filed through mail-in forms.

With advancements in digital accessibility, employers are no longer restricted to filing their quarterly contribution report via mail. The option to file online through the website www.labor.state.ak.us/estax is available, offering a more convenient and faster way to meet filing requirements. - Myth 3: Wage information once submitted is set in stone and cannot be corrected.

Another common misconception is that once the Alaska Quarterly Contribution Report is filed, any mistakes made in the wage information are irreversible. However, employers have the option to amend their quarterly reports by submitting a “Correction of Wage Item,” Form TADJ, which allows the rectification of previously submitted wage data. - Myth 4: Contributions are only used for Unemployment Compensation (UC) purposes.

While it’s true that one of the primary purposes of collecting employer contributions is to fund the unemployment compensation program, it’s important to note that wage information and other data provided in the report may be requested and utilized for other authorized governmental purposes. This includes, but is not limited to, verification of an individual’s eligibility for other government programs, underscoring the broader utility of the information beyond UC benefits.

Misunderstandings about the Alaska Quarterly Contribution Report form can lead to unnecessary errors and oversights. By clarifying these points, employers can better navigate the process, ensuring compliance and contributing to a more efficient system of reporting and record keeping within the state.

Key takeaways

Filing the Alaska Quarterly Contribution Report is essential for employers operating within the state. It encompasses various critical elements that warrant attention to ensure compliance and accuracy in reporting. Here are key takeaways regarding this report:

- Employers are required to file this report every quarter, even if they did not pay wages during that period. This mandatory filing ensures compliance with state employment laws.

- The report can be submitted online, offering convenience and efficiency to employers. The Alaska Department of Labor and Workforce Development provides resources and assistance for online filing.

- Any necessary amendments to a previously submitted report should be completed using the "Correction of Wage Item," or Form TADJ, which is also accessible online, highlighting the state's move towards streamlined digital processes.

- Confidential unemployment compensation (UC) information reported by employers may be utilized for verifying an individual's eligibility for other government programs, indicating the broader governmental use of this data.

- The report requires employers to list the number of workers for each month who worked during or received pay for the payroll period that includes the 12th of the month, ensuring precise workforce tracking.

- Taxable wages are to be reported after deducting excess wages above the taxable wage base, which was set to $36,900 for the year 2013. This calculation is crucial for determining the correct amount of contributions due.

- Both employer's and employee's contributions to the unemployment insurance are calculated as percentages of the taxable wages, with distinct rates outlined in the report form for each.

- The report form also inquires whether wages were reported to other states, facilitating the proper allocation of unemployment insurance funds and avoiding dual contributions for the same wages.

This guided approach to filling out the Alaska Quarterly Contribution Contribution Report form ensures that employers provide accurate and comprehensive employment data. By adhering to these steps, employers contribute to the efficiency and effectiveness of Alaska's employment and labor force development initiatives.

Find Popular Templates

Alaska C03 - With a focus on privacy, the C03 form lets Alaskans keep their residence address confidential while registering to vote.

Alaska Guardianship Forms - The form also queries on communication and visits between the guardian and the ward to assess their relationship.